We would like to thank you for your trust, deciding to include our managed accounts in your investment portfolio. We provide you with multiple investment options that help diversifying your portfolio, and are using the PAMM software that allows you to protect your funds, and optimize the performance.

You are accessing your account via the online backoffice, while your account is part of the Hybrid PAMM. It is an advanced PAMM software with added protection tools, however this also makes it a bit more complex. You should find all that you need for your account here:

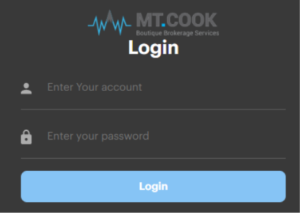

ACCESSING YOUR ACCOUNT’S BACKOFFICE

Please use the log in details provided to you by the broker, and log into your account:

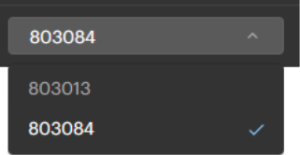

When you have more than one account, you can access them all through the backoffice by clicking on the top left menu ![]() :

:

UNDERSTANDING THE ACCOUNT REPORT

When logged into your account, the best way to check your account’s performance is the following:

1. Choose

2. Choose ![]()

3. Set custom Date Range

4. Click on ![]()

You should see this table at the bottom of the page:

The most important category is the Net Equity, as that is the actual account value at the end of the chosen period. If you are pulling the report for today, then the Net Equity will be the value of your account at this very moment. You can access your funds at anytime.

The report will also show additional tables:

- Closed Positions (trades that have been closed)

- Pending Orders (any orders pending for execution)

- Account Activity (a detailed list of daily settlements, per category)

It is important to add that when clients join the PAMM while the PAMM is in open positions, the trades will not perfectly match, until the account is synchronized with the PAMM. The reason for this occurrence is the defense mechanism of the Hybrid PAMM, as it will not allow to open any trades with the instrument that had open positions during the time the managed account was attached. Account and the PAMM will synchronize as soon as every instrument is flat for the first time.

RISK AND PROTECTION SETUP

The Hybrid PAMM allows you to set up the account to your requirements. You have the ability to set the following:

- Position multiplier (how intensively your account trades)

- Stop Equity (the level at which your account will stop trading if reached)

- Ability to unsubscribe from trading (this will automatically close all your trades, and stop following the PAMM)

This menu can be found in your backoffice:

- Choose

- Choose

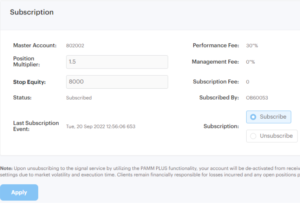

The menu looks like this:

Setting the Position Multiplier:

Set the Position Multiplier here: ![]() and click on

and click on ![]()

Set this rate anywhere from 0.1 to 2.0 (the example above is showing 1.5). If you would like to set the rate anywhere from 2.1 to 4.0, you would need to contact the brokerage at accounts@mtcookfinancial.com.

The Position Multiplier will increase or decrease your risk compared to the master account that you are following. It is set to “1” by default, which means your account is trading at the same risk as the PAMM. The rate below 1 will trade at a lower risk, and the rate above 1 at higher.

Setting the Stop Equity:

Set the Stop Equity here: ![]() and click on

and click on ![]()

You account will close all trades and stop trading if it reaches the equity you have preselected (the example above is showing 8,000).

Unsubscribing the account from the PAMM:

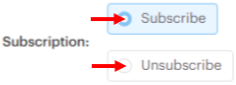

You have an ability to unsubscribe or subscribe back to the PAMM. Unsubscribing will close all your trades, while subscribing back will allow your account to start receiving the trades once again:

and click on

and click on ![]()

ADDING FUNDS

You can always add more funds to any of your accounts. You would do so by making a new deposit. In the backoffice choose  then

then ![]()

Your funds should be added to your account once received by the brokerage.

If you would like to open a new account, and have it placed on a different PAMM, simply email the brokerage at accounts@mtcookfinancial.com to open a new account, and submit the LPOA. You can fund the new account either by transferring funds from your other account, or sending new funds.

TRANSFERRING FUNDS AMONG YOUR ACCOUNTS (INTERNAL TRANSFER)

You can transfer funds between your brokerage accounts. In order to do that, choose  then

then ![]() . In the menu, choose the account you would like to transfer funds to, and the amount. In the end hit

. In the menu, choose the account you would like to transfer funds to, and the amount. In the end hit ![]() .

.

WITHDRAWAL OF FUNDS

You can withdraw your funds at anytime. Before withdrawing, you need to make sure that you have updated your bank details. It is done in the backoffice:

First choose  then

then ![]() , and update your bank details. Then click

, and update your bank details. Then click ![]() once you’ve entered your bank details. This process only needs to be done once.

once you’ve entered your bank details. This process only needs to be done once.

For placing a withdrawal, go to  then

then ![]() . When done, click on

. When done, click on ![]() .

.