Evidence Based Investing

People hate losing money, more than they enjoy making money

People hate losing money, more than they enjoy making money

The perceived pain derived from a loss, hurts significantly more than the perceived pleasure derived from an equivalent gain.

So putting it in relevant context, earning $1000 doesn’t create nearly as much joy as the pain created by losing $1000. For most, this emotion is just natural human nature and interestingly enough is even evident in other species.

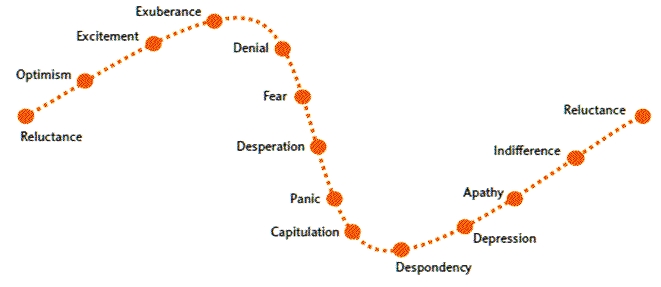

It’s ironic but because of this emotional imbalance, investors are more inclined to avoid risk in a “gain scenario”, while in a “loss scenario” we are more inclined to seek it out. This amplified pain as a result of losing money significantly influences investors and INHIBITS the ability to make reasonable investment decisions or commit to investment plans. This is perhaps one of the most important factors to understand when designing an investment strategy for investors.

By building our business around this simple model, and understanding the way we think, we are essentially helping ourselves to have much better chances to succeed.

We do this by hacking our psychology and aligning ourselves with it – instead of clashing against it.

Thus, our investment strategy is based on the following key principals:

We are firm on the opinion that purely discretionary/manual trading styles, and long term “hold and hope” strategies are not only ineffective in the FX markets, but that they are not suitable for most investors, and that firm enough evidence exists from various data sources to suggest that these ultimately turn out to be poor investments over the long term.