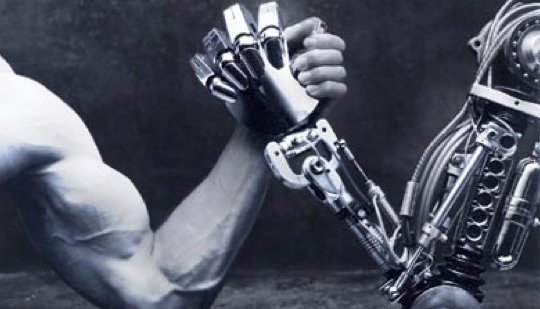

The Great Man vs. Machine Debate in Financial Markets

As the world becomes increasingly digitized, many industries have turned to artificial intelligence (AI) and machine learning (ML) to improve efficiency and accuracy. One such industry is finance, where algorithms and trading bots have become commonplace. But what about the role of human expertise in financial decision-making? Is there still a place for the “great man” in financial markets, or are machines taking over?

A recent article in a finance publication explored this topic, examining the pros and cons of relying on humans vs. machines in financial decision-making. While the article made some valid points, it missed the larger issue at hand.

On the one hand, machines have many advantages over humans in the financial world. They can process vast amounts of data quickly and accurately, and they can operate 24/7 without fatigue or emotion. This allows for rapid decision-making and can lead to increased profits for investors. For example, in 2010, a so-called “flash crash” occurred in which the stock market plummeted 1,000 points in just minutes, partly due to too much reliance on computers and algorithms to execute trades.

However, there are also drawbacks to relying solely on machines. For one, they can be prone to errors if the algorithms are not properly designed or if they are based on faulty assumptions. Additionally, machines lack the nuanced understanding of human behavior and market trends that can only come from years of experience and expertise.

As technology continues to advance, the debate around the role of humans vs. machines in finance is only intensifying. For instance, the development of quantum computers has the potential to revolutionize the financial industry by exponentially increasing the speed and accuracy of calculations, leading to even greater reliance on machines. However, this also raises concerns about the security of financial data and the potential for malicious actors to exploit vulnerabilities in these systems.

So where does this leave us in the great man vs. machine debate in financial markets? The answer is not so simple. While machines can certainly be powerful tools for investors, they should not be relied on exclusively. Instead, a combination of human expertise and machine learning is likely the best approach.

This hybrid approach allows for the best of both worlds. Humans can provide the context and understanding that machines lack, while machines can process data at a speed and accuracy that humans simply cannot match. When working together, humans and machines can make more informed and profitable investment decisions.

In conclusion, the great man vs. machine debate in financial markets is not a zero-sum game. Instead, a combination of human expertise and machine learning is likely the best approach for making informed investment decisions. As the finance industry continues to evolve and digitize, it is important to recognize the strengths and limitations of both humans and machines, and to leverage them in tandem to achieve the best possible results. However, it is also crucial to monitor and address potential risks and challenges that arise from increasing reliance on machines and the rapid pace of technological advancement.